Venture Capital (VC) is often viewed as the lifeblood of innovation, fueling startups and driving the creation of transformative technologies. It’s the reason we have everything from smartphones to space exploration startups today. But VC is more than just money—it’s about ideas, vision, ambition, and the positive impact of creating something new and disruptive. This guide will help the readers to navigate the intricate world of VC, combining both historical context and interesting facts to keep it engaging.

What is Venture Capital?

At its core, venture capital is a form of private equity that provides financing from investors to early-stage, high-potential startups and small businesses. What makes VC unique is its high-risk, high-reward nature: VCs invest in companies that are often still in their infancy, with no guarantees of success. In return, they receive equity—a stake in the company that could yield enormous wealth if the business thrives.

But VC is not just about writing checks. VCs often play an active role in the company, offering strategic guidance, access to networks, and support with scaling operations. The famous line in Silicon Valley is that venture capitalists bring “smart money”—not just capital but also mentorship, resources, and connections to help startups grow.

The Birth of Modern Venture Capital

To truly appreciate the VC landscape, it helps to know how it began. VC as we know it today didn’t exist before World War II. One pivotal figure in its history is George Doriot, a French-born Harvard Business School professor, often dubbed the “Father of Venture Capital.”

In 1946, Doriot founded the American Research and Development Corporation (ARDC), with the goal of turning innovative wartime technologies into commercial successes. His vision was groundbreaking: instead of backing only large, established companies, ARDC would invest in young startups. In 1957, ARDC made its first big bet on Digital Equipment Corporation (DEC). Their $70,000 investment turned into $355 million when DEC went public—one of the earliest success stories of VC.

Interesting Fact: Doriot’s vision was ahead of its time, and his legacy laid the groundwork for how modern VC firms operate today—by backing bold, innovative entrepreneurs with the potential to disrupt industries.

The Rise of Silicon Valley

The VC industry truly exploded in the late 20th century with the rise of Silicon Valley. In the 1970s and 1980s, as personal computers, semiconductors, and software began to revolutionize industries, investors in Silicon Valley started to take center stage. The world began to witness the rise of iconic companies like Apple, Intel, and Microsoft, which received critical early funding from VCs.

One of the transformative moments for the VC industry was the Employee Retirement Income Security Act (ERISA) in 1979. Before this change, pension funds could not invest in VC due to the high risk. ERISA lifted these restrictions, opening the floodgates for billions of dollars to flow into the VC ecosystem.

Interesting Fact: Some of the first venture-backed companies like Apple and Google have now grown into global powerhouses worth trillions. Had you invested just $1,000 in Apple in 1980, that investment would be worth millions today. VCs who saw this potential early on made astronomical returns.

Key Players in the Venture Capital Ecosystem

To understand how VC works, it’s essential to identify the key players involved.

- Venture Capitalists (VCs): These are the investors who provide funding to startups. They are often organized into firms (like Sequoia Capital, Andreessen Horowitz, or HASAN.VC) that manage large sums of money and distribute it across a portfolio of startups. Venture capitalists don’t just offer money; they offer guidance, mentorship, and industry connections.

- General Partners (GPs): General partners are the individuals who actively manage the VC fund. They are responsible for making investment decisions, managing the fund’s operations, and working closely with startups to drive growth. GPs typically receive a share of the fund’s profits, known as “carried interest.”

- Limited Partners (LPs): These are institutional investors (such as pension funds, endowments, or wealthy individuals) that invest their money into VC funds. LPs provide the capital that venture capitalists then deploy into startups.

- Founders/Entrepreneurs: These are the people building the businesses. Founders like Steve Jobs (Apple), Mark Zuckerberg (Facebook), and Elon Musk (Tesla) have all, at some point, relied on VC to turn their ideas into reality.

- Angel Investors: Often the first to fund startups, angel investors are high-net-worth individuals who invest their personal funds into very early-stage companies with a high potential to grow exponentially. They often provide critical support before VCs get involved.

Interesting Fact: Early investors in Google, saw their money multiply hundreds of times over after the company went public in 2004. Google’s IPO created over 1,000 millionaires among its employees and investors.

The Venture Capital Process

The VC process is typically divided into several stages, and each stage reflects the startup’s growth and needs for capital:

- Seed Stage: The very beginning of the journey, where an idea is turned into a product. At this point, there might be little more than a concept or prototype, and funds are needed to test the business model. Some of the world’s biggest companies, like Dropbox and Airbnb, started out in the seed stages with minimal capital. Startups may also join incubators or accelerators at this stage, which provide early funding, mentorship, and resources to help develop the idea.

- Early Stage (Series A & B): This stage involves scaling up. Startups have typically launched a product and are generating early revenues, but they need funding to hire teams, expand operations, and grow the customer base. For example, Uber used Series A funding to move beyond its San Francisco origins and expand to other cities.

- Growth Stage (Series C and beyond): At this point, companies are generating substantial revenues and have proven that their business model works. They raise funds to expand globally, acquire competitors, or develop new products. Facebook, for instance, raised large sums in its growth stage to build out its platform and enhance its advertising model.

- Late Stage: This stage occurs when companies are nearing an exit event, such as an initial public offering (IPO) or acquisition. Late-stage investors are looking for established companies with a clear path to profitability. Spotify, for example, raised late-stage capital just before its IPO in 2018 to position itself for long-term success.

Interesting Fact: Airbnb was rejected by several VCists during its early stages. Today, the company is worth billions, and the early investors who took a chance on the startup have seen incredible returns.

How Venture Capitalists Evaluate Startups

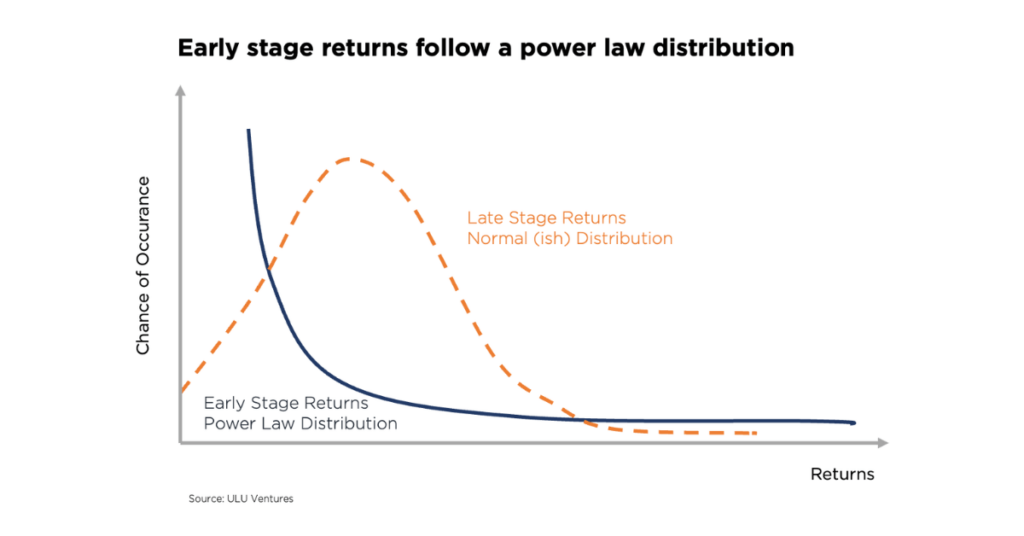

Venture capitalists look at several factors before deciding to invest. But here’s a little-known secret: most VCs expect that the majority of their investments will fail. In fact, VC is often referred to as a “home run” game. The idea is that a single successful investment (like Google or Facebook) can more than make up for multiple failed investments.

VC follows a power law distribution, where a small number of investments generate the majority of returns. The idea is that while most startups in a VC’s portfolio may not perform well or even fail, one or two “home runs” can deliver massive returns, far exceeding all the losses combined. This is why VCs are laser-focused on identifying high-potential startups that can become billion-dollar businesses. For instance, Sequoia Capital’s early investment in WhatsApp returned a whopping $3 billion from an initial $60 million investment. In a typical VC fund, around 10% of the companies will account for over 90% of the total returns, underscoring the importance of backing “moonshots.”

So, what are VCs looking for?

- Market Size: The market needs to be large enough to support a billion-dollar business. This is why VCs prefer startups in sectors like healthcare, fintech, and technology, where the potential for disruption and growth is immense.

- Team: This is often the most critical factor. VCs are not just betting on an idea—they’re betting on the people behind the idea. Steve Jobs, for instance, was able to pivot Apple’s business multiple times because of his unique vision and leadership.

- Product or Technology: VCs look for startups that are solving big, pressing problems with innovative solutions. They seek companies with strong “moats,” meaning their products are hard for competitors to replicate. Tesla’s success in electric vehicles, for instance, is partly due to its cutting-edge technology and innovative approach to energy storage.

- Traction: Startups with early traction, such as strong user growth or strategic partnerships, are more likely to attract funding. Slack, for example, grew its user base rapidly in its early days, making it an attractive option for VCs.

However, these factors are not exhaustive; VCs consider several additional elements based on the stage of the company, the industry, and market dynamics. Timing is also a critical factor—VCs look for startups that are entering the market at the right moment, ensuring that the product or service is neither too early nor too late to gain traction. Each investment decision is tailored to the unique circumstances of the startup and its potential for growth.

The Risks and Rewards of Venture Capital

VC is high-risk, but the rewards can be enormous. For every success story like Uber or Instagram, there are hundreds of startups that never make it. Yet the allure of being part of the next transformative technology or billion-dollar company keeps investors coming back.

Example: Webvan, an early online grocery delivery service that raised over $800 million in VC funding, became one of the biggest failures of the dot-com bubble when it went bankrupt in 2001. But for every Webvan, there’s a Zoom—which grew exponentially during the pandemic, turning its early investors into billionaires.

The VC model thrives on the understanding that not all investments will succeed, but those that do can generate significant returns that far outweigh the losses. To mitigate risk, VC firms often diversify their investments across multiple sectors and stages of growth, allowing them to balance potential failures with successes. HASAN.VC exemplifies this strategy by investing in over 40 different halal and ethical companies across various sectors and industries, maximizing returns while minimizing overall portfolio risk.

Interesting Fact: Sequoia Capital, one of Silicon Valley’s most famous VC firms, has invested in companies that now represent over $3 trillion in combined market value, including Apple, Google, YouTube, and WhatsApp.

Key Terms to Know

To navigate the world of VC, it’s essential to understand some key terms:

- Equity: The ownership stake in a company. VCs receive equity in exchange for their investment, and their returns depend on how much that equity is worth when the company exits.

- Valuation: The estimated worth of the company at different stages of funding. Facebook’s valuation soared to billions before it went public in 2012, thanks to multiple funding rounds from VCs.

- Term Sheet: A document that outlines the terms of the investment. It includes details about the amount invested, the valuation of the company, and the rights of the investors.

- Dilution: As startups raise more funding and issue new shares, the ownership percentage of existing shareholders decreases. For example, when Dropbox raised additional rounds of funding, its early investors experienced dilution but benefited from the company’s overall growth.

- Exit Strategy: The way in which VCs plan to make a return on their investment, either through an IPO (initial public offering) or acquisition. WhatsApp’s acquisition by Facebook for $19 billion is a classic example of a lucrative VC exit.

Muslims and Venture Capital: The Path to Ethical Innovation

Over the last few years, VC has become a key driver of innovation, entrepreneurship, and economic transformation in the Muslim world. Islamic finance, with its foundation on fairness, risk-sharing, and ethical investing, naturally aligns with most principles of VC. Unlike conventional debt-based financing, VC fosters a model of shared risk and reward, making it an appealing avenue for Muslim entrepreneurs and investors who seek to uphold Islamic values in their financial dealings.

The growth of halal VC funds like HASAN.VC and other Islamic investment vehicles has been instrumental in merging ethical finance with the high-energy world of startups. These funds, while operating within the traditional VC framework, introduce rigorous ethical filters—investing in businesses that align with Islamic principles and avoiding industries such as alcohol, gambling, and interest-based financial services. By doing so, they allow Muslim investors to participate in emerging markets without compromising their faith.

Moreover, VC is empowering a new generation of Muslim entrepreneurs who aim to make a positive impact. Whether through fintech startups providing ethical banking solutions or tech-driven companies addressing global challenges in healthcare, education, and sustainability, these founders are combining their faith-based values with entrepreneurial ambition. The result is a flourishing ecosystem that promotes ethical business practices while leveraging cutting-edge innovation.

Fun Fact: The Islamic fintech sector alone is projected to hit $128 billion by 2025. This staggering figure underscores the growing influence of VC in propelling startups that cater to the unique needs of the global Muslim population—especially in offering financial services that align with Shariah principles.

A New Era of Ethical Investing

VC is more than a source of funding; it’s a catalyst for turning ideas into reality. Muslim investors are increasingly recognizing its potential to create positive social and economic impact while staying true to their ethical and religious beliefs. With the right combination of vision, innovation, and support from halal VC funds, startups in the Muslim world are positioned to shape industries and create sustainable, long-term growth. Notably, in the past year, a few unicorns have emerged from the Islamic world, and prominent VC firms have aggressively invested in halal and ethical startups over the last two years, further highlighting the vast potential within the Muslim world.

Did You Know? Some of the world’s most innovative companies—like Google, Tesla, and Airbnb—started out as risky ventures with uncertain futures. With the backing of VC, these companies have grown into industry giants, proving that with the right mix of bold ideas and strategic investment, extraordinary things are possible.

Final Thoughts

VC isn’t just about providing financial backing—it’s about bringing visionary ideas to life. For every company that fails, there’s another poised to change the world. From Apple’s humble garage beginnings to Tesla’s mission to revolutionize energy, venture capitalists have been at the forefront of innovation for decades.

For those just beginning their journey, understanding the fundamentals of VC provides a window into how startups are built and how investors can participate in the creation of future industries. Whether you’re a founder looking for funding or an aspiring investor seeking to make an impact, VC offers incredible opportunities to be part of the next big thing.

The rise of VC in the Muslim world marks the dawn of a new era for ethical investment and entrepreneurship. This growing ecosystem provides a platform for entrepreneurs with groundbreaking ideas and investors seeking to make a meaningful, values-driven impact. As VC continues to expand within the Muslim world, it promises to drive economic growth, solve real-world challenges, and uphold the ethics that guide the community.

Ready to embark on this journey? HASAN.VC offers a unique platform for investors to come together and fuel the next wave of ethical startups, serving humanity and the Muslim community in particular. Join HASAN.VC’s thriving community now and be part of this transformative change, with the opportunity to achieve success both in this world and the hereafter.

Click on the link below and join our thriving HASAN.VC community.

Frequently Asked Questions

1. What is venture capital and how does it work?

Venture capital (VC) is a type of private equity investment provided by firms or individuals to startups and early-stage businesses with high growth potential. In exchange for funding, VCs receive equity or partial ownership in the company. VC firms often offer mentorship, strategic advice, and connections, making them more than just financial backers.

2. Who are the main players in the venture capital ecosystem?

The venture capital ecosystem includes:

- Venture Capitalists (VCs) – Investors who fund startups.

- General Partners (GPs) – Professionals managing VC funds and making investment decisions.

- Limited Partners (LPs) – Institutions or individuals that provide the capital.

- Founders/Entrepreneurs – Individuals building the startups.

- Angel Investors – High-net-worth individuals who invest early in startups.

3. What are the stages of venture capital funding?

VC funding typically follows these stages:

- Seed Stage – Early product or concept development.

- Series A & B (Early Stage) – Scaling product and user base.

- Series C and beyond (Growth Stage) – Market expansion and acquisitions.

- Late Stage – Pre-IPO or acquisition preparation.

4. How do venture capitalists evaluate startups?

VCs assess startups using key criteria:

- Market size – Is the market large and scalable?

- Founding team – Does the team have vision, grit, and expertise?

- Product or technology – Is it innovative and defensible?

- Traction – Are there signs of growth, user interest, or revenue?

- Timing – Is the market ready for this product or service?

5. What is the difference between venture capital and angel investing?

Angel investors are usually individuals investing their personal funds in very early-stage startups, often before VCs get involved. Venture capitalists typically manage funds from multiple sources and invest in startups with more traction or scalability.

6. What are common exit strategies in venture capital?

The two most common VC exit strategies are:

- Initial Public Offering (IPO) – The startup goes public on a stock exchange.

- Acquisition – The company is bought by a larger firm.

These exits allow VCs to earn returns on their investment.

7. What are some risks involved in venture capital investing?

VC is a high-risk, high-reward investment strategy. Most startups fail, and VCs rely on a few “home run” investments to generate returns. Losses are common, but a single successful startup (like WhatsApp or Airbnb) can offset multiple failures.

8. How is Islamic or halal venture capital different?

Halal or Islamic VC aligns with Shariah principles, avoiding industries like alcohol, gambling, and interest-based finance. It emphasizes fairness, ethical investing, and risk-sharing. Funds like HASAN.VC invest only in companies that meet these ethical criteria, supporting Muslim entrepreneurs and ethical innovation.

9. What is equity and why is it important in VC?

Equity represents ownership in a company. VCs receive equity in exchange for their capital, which entitles them to a portion of the company’s profits and potential exit proceeds. Equity is the primary way VCs make returns on their investments.

10. What does a term sheet in VC include?

A term sheet is a non-binding document that outlines the terms of a VC investment. It typically includes:

- Investment amount

- Company valuation

- Equity percentage

- Rights and responsibilities of each party

11. What is dilution and how does it affect startup founders?

Dilution occurs when new shares are issued during additional funding rounds, reducing the ownership percentage of existing shareholders. While dilution lowers percentage ownership, the value of shares can still grow if the company increases in value.

12. How can Muslims participate in ethical venture investing?

Muslim investors can invest through halal VC funds like HASAN.VC, which work closely with Adl Advisory to screen companies based on Shariah principles. These platforms allow Muslims to support ethical startups and participate in wealth creation without compromising faith-based values.

Stay ahead of the queue by joining our mailing list for latest updates on events and investment opportunities.