Rethinking Venture Capital: HASAN.VC’s Bold Departure from Silicon Valley Norms

The Silicon Valley venture capital (VC) model, long celebrated for birthing global unicorns, may not be the best fit for every region — especially Southeast Asia. That’s the view of HASAN.VC, a values-driven VC firm that’s challenging conventional investment strategies and rewriting the rules for startup growth in the region.

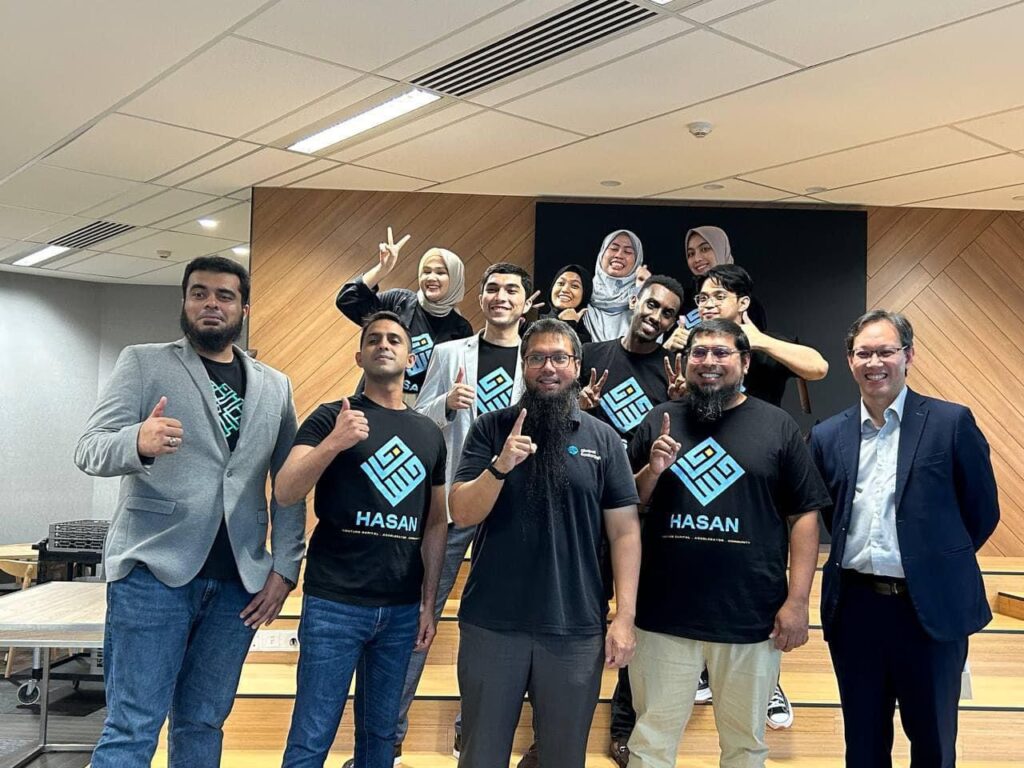

In a recent interview with Roshan Kanesan on BFM 89.9 (June 5, 2025), Umar Munshi, Managing Partner at HASAN.VC, shared his insights on why the Silicon Valley playbook is misaligned with the realities of Southeast Asian markets — and how his firm is carving out an alternative path rooted in ethics, sustainability, and founder empowerment.

From Unicorns to Camels: The “Camel Manifesto” Explained

At the heart of HASAN.VC’s philosophy is a rejection of the hypergrowth-at-all-costs mentality. Instead of chasing unicorns — startups valued at over $1 billion — HASAN.VC promotes building camels, a metaphor for resilient, self-sustaining startups that can weather market volatility and grow sustainably.

“What if venture capital wasn’t built to chase unicorns in Southeast Asia, but to build camels instead?”

The Camel Manifesto shifts the focus from flashy valuations and rapid exits to long-term viability, steady growth, and operational robustness. This framework, HASAN.VC argues, is far more suited to the fragmented, culturally diverse, and infrastructure-challenged landscape of Southeast Asia.

Why the Silicon Valley VC Model Doesn’t Fit Southeast Asia

Umar Munshi notes that the traditional VC model — based on homogenous markets and rapid scaling — often fails in fragmented markets like Southeast Asia. The region comprises diverse regulatory environments, languages, and consumer behaviors that complicate cookie-cutter approaches.

“We explore the origins and philosophy behind HASAN.VC’s Camel Manifesto, which champions long-term sustainability over hypergrowth.”

Rather than force-fitting startups into a flawed model, HASAN.VC is rethinking venture capital for Southeast Asia and beyond, emphasizing patient capital, adaptability, and deep local knowledge.

Investing with Values: Ethical and Halal-Aligned Startups

HASAN.VC integrates a values-based investment strategy, prioritizing ethical and halal-aligned startups that adhere to Islamic finance principles. This commitment goes beyond compliance — it’s about building a moral foundation for entrepreneurship.

“[HASAN.VC] is rethinking venture capital with a focus on ethical, halal-aligned startups grounded in resilience, not hype.”

Their investment framework includes Shariah-compliant alternatives to SAFE notes, ensuring that funding mechanisms respect both financial ethics and religious principles — a rare, but growing trend in VC.

Building a Founder-Friendly Ecosystem

Another cornerstone of HASAN.VC’s approach is their commitment to building a more founder-friendly VC environment. Recognizing the often exploitative dynamics in traditional VC relationships, HASAN.VC is flipping the script.

They’ve launched a hands-on accelerator and a venture studio in Kota Bharu, designed to support founders with more than just capital — offering mentorship, community, and aligned strategic partnerships.

“[HASAN] is building a more founder-friendly ecosystem, including a hands-on accelerator and a new venture studio in Kota Bharu.”

Angel-Powered VC: Decentralizing Investment Influence

HASAN.VC is also pioneering an angel-powered VC fund, leveraging the insights and resources of individual investors rather than relying solely on institutional capital. This not only democratizes investment opportunities but also promotes a more decentralized and diverse investor ecosystem.

“[Discussion on] How HASAN.VC is building an angel-powered VC fund.”

Lessons from Equity Crowdfunding & Ethical Investing for Everyone

With roots in equity crowdfunding through Ethis Group, Umar Munshi brings a unique perspective on alternative financing models. This background helps inform HASAN.VC’s broader commitment to ethical investing — an approach that extends beyond Islamic finance and resonates with a global audience interested in responsible capital.

“[Discussion on] What ethical investing means in practice, and why it’s for everyone.”

Conclusion: A New VC Paradigm for Southeast Asia

HASAN.VC’s critique of the Silicon Valley model isn’t just theoretical — it’s backed by actionable frameworks, alternative financial instruments, and real-world initiatives aimed at sustainable and ethical entrepreneurship.Their Camel Manifesto represents more than a metaphor — it’s a practical strategy tailored for Southeast Asia’s complexities. By aligning capital with values, empowering founders, and focusing on resilience, HASAN.VC is pioneering a more inclusive, effective, and ethical future for venture capital in the region.

This is a featured article on

Click here to read the article on BFM 89.9

Stay ahead of the queue by joining our mailing list for latest updates on events and investment opportunities.