Riyadh- and Singapore-based web3 startup Takadao has raised a total of US$3.1 million following the close of its US$1.5 million seed round, as it launches The LifeCard, a community-owned prepaid crypto VISA card designed to bridge decentralized finance (DeFi) with everyday spending.

The latest round drew participation from HASAN.VC (Malaysia), Syla Invest (France), Wahed Ventures (UK), Ice Blue Fund (Japan), Istari Ventures (US), and Adaverse (Saudi Arabia), with follow-on funding from Draper Associates of Silicon Valley. The round targeted investors aligned with Takadao’s community-first and Shariah-compliant mission.

“We wanted to raise from partners who understand our vision of building a community-owned, ethical financial ecosystem,” said Morrad Irsane, co-founder and CEO of Takadao. “Hasan VC, Wahed Ventures, and others give us access to Southeast Asian, European, and Anglo markets where our community is already growing.”

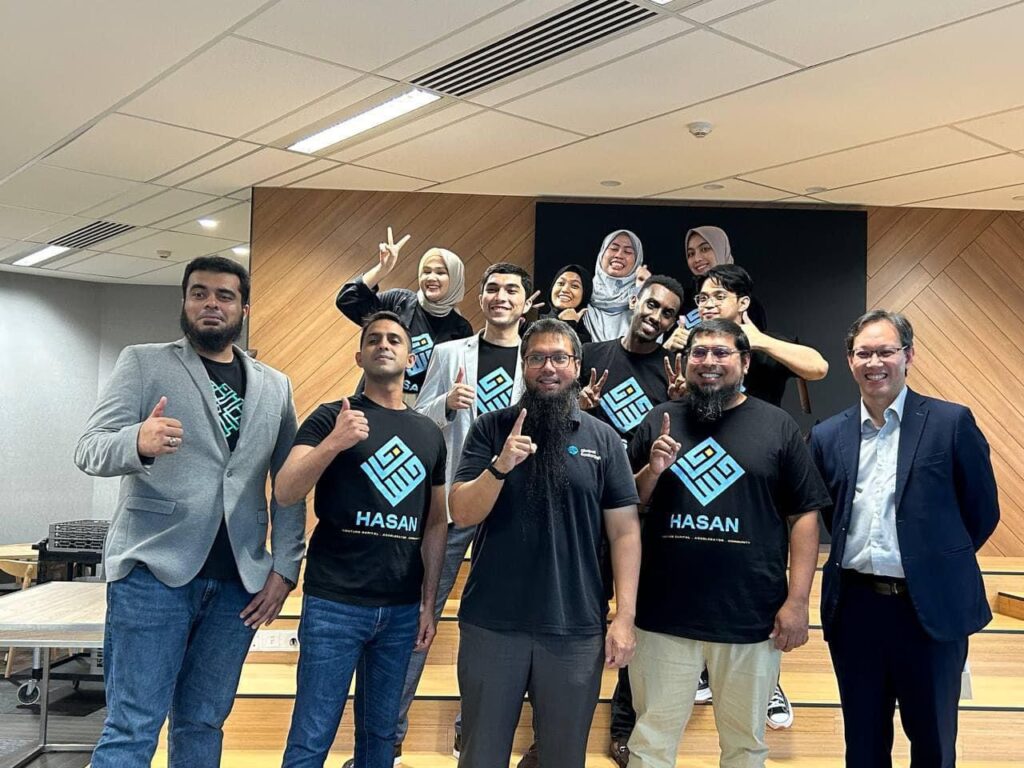

For HASAN.VC, Takadao represents the emerging class of “camel startups”; resilient, mission-driven ventures building long-term, values-aligned economic infrastructure.

“Takadao is reshaping what ethical fintech can look like in the Web3 era,” said Umar Munshi, General Partner at HASAN.VC. “Their model aligns perfectly with our commitment to empower founders who build with integrity, transparency, and impact. Supporting Takadao means supporting a future where communities own their financial tools.”

Takadao’s underlying protocol powers The LifeDAO, a self-described Community-Owned Nobank that gives members decentralized tools for saving, investing, and financial protection. Members own and control their deposits directly, not Takadao, with operational surplus redistributed back into the community. The LifeDAO currently holds around US$1 million in total value locked (TVL) across affiliated funds.

The LifeCard, unveiled alongside the funding announcement, is the newest addition to this ecosystem. It allows users to spend stablecoins like cash anywhere VISA is accepted, offering a critical real-world use case for crypto users.

“The LifeCard creates a tangible bridge between Web3 assets and daily life,” said Sharene Lee, co-founder and COO. “Members can now use their life protection payouts, pooled investment returns, or even community rewards in stablecoins for everyday expenses.”

Designed with financial inclusivity and community ownership at its core, the LifeCard introduces several distinctive features: profit-sharing from card fees, automatic round-ups for savings and investing, and a 0% interest microloan model based on usage history.

“Profit sharing and interest-free financing aren’t just features—they’re reflections of our community values,” Irsane added. “Our aim is to make wealth creation and protection both halal and accessible.”

With this dual announcement, Takadao strengthens its position within the growing Islamic fintech and decentralized finance sectors, where ethical investing, transparency, and user ownership are redefining the future of finance.

This is a featured article on

Click here to read the article on Barakah Insider

Stay ahead of the queue by joining our mailing list for latest updates on events and investment opportunities.