The development of halal startups in Indonesia continues to show promise, even as the global “tech winter” phenomenon persists, posing challenges for emerging tech companies.

The tech winter, often described as a period where startups struggle to secure funding, has led to the closure of several ventures globally. However, industry leaders believe that the current climate offers unique opportunities for halal startups in Indonesia.Ronald Yusuf Wijaya, Chairman of the Indonesian Sharia Fintech Association (AFSI), acknowledged that the tech winter has impacted Indonesian startups, but also emphasized that it presents a strategic moment for investors committed to halal investments.

“While some venture capital firms and financial institutions are exercising caution due to global economic uncertainties, I believe many retail investors still recognize the potential in supporting halal startups. The halal industry is poised for significant growth in the coming years, and now is the time to invest,” said Ronald during a press briefing in Jakarta.

Supporting this outlook, Imam Hartono, Head of the Department of Islamic Economics and Finance (DEKS) at Bank Indonesia (BI), highlighted the substantial potential of Indonesia’s digital economy, which accounts for 40 percent of the ASEAN digital economy. He identified five key sectors for the halal industry’s growth: food and beverage, tourism, cosmetics, fashion, and pharmaceuticals. Imam also detailed BI’s initiatives to bolster the halal industry through enhanced payment infrastructure.

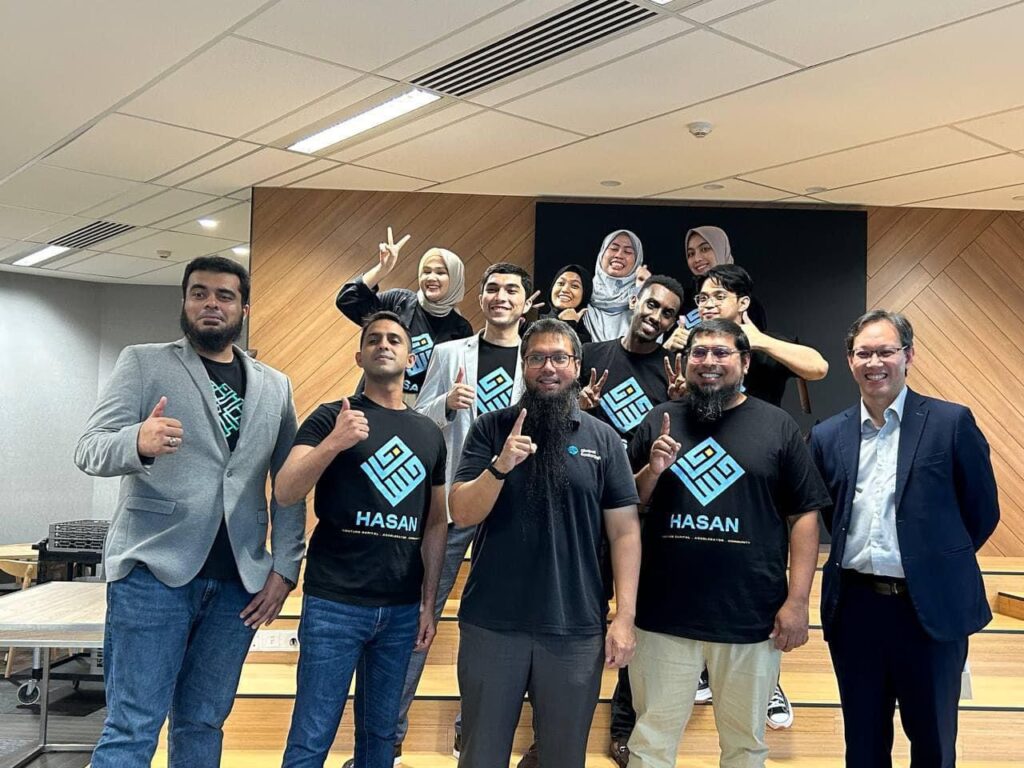

“First, we launched the Indonesian Standard Quick Response Code (QRIS), which now has around 200 million users. QRIS is not only used domestically but also in five countries: Malaysia, Singapore, Thailand, South Korea, and India, including for halal transactions. Secondly, BI Fast facilitates swift, efficient, and secure interbank payments, supporting financial institutions’ transactions. Lastly, we introduced SNAP to strengthen governance, consumer protection, and customer assurance,” Imam explained.In a bid to further drive the growth of the halal startup ecosystem, HASAN Venture Capital & Accelerator (HASAN.VC), in collaboration with AFSI, BI, and the Sharia National Economic and Financial Committee (KNEKS), hosted the Halal Super Angels (HASAN.VC) Demo Day Jakarta 2024. Themed “Innovate for Impact: Bridging Borders, Building Futures,” the event showcased innovative solutions addressing global halal industry challenges.

The event attracted over 200 potential investors from across the globe and served as an acceleration platform for 18 cutting-edge halal startups from Indonesia, Malaysia, and Singapore. “Halal Startup Demo Day 2024 is a tangible step in advancing the halal startup ecosystem in Indonesia. We hope this event acts as a catalyst for the halal industry’s growth, attracting both domestic and international investors, and inspiring more innovators in the halal sector,” said Umar Munshi, Managing Partner of HASAN.VC.

This is a featured article on

Click here to read the article on infobanknews.com

Stay ahead of the queue by joining our mailing list for latest updates on events and investment opportunities.